Intercompany Solutions: Starting a business in the Netherlands

Why Choose To Start A Dutch Business?

Why work with Intercompany Solutions?

Our experience with international entrepreneurs has allowed us to perfectly adjust our processes in order to ensure the successful and rapid establishment of your Dutch company. Customer satisfaction is guaranteed for all the services we offer.

Our Scope Of Expertise:

- Starting a Dutch business: the complete package

- Assistance with local regulations

- Application for an EORI or VAT number

- Accounting and other financial assistance

- Application for a company bank account

- Secretarial support: premium package

Associations And Memberships :

We are constantly improving our quality standards to continually deliver impeccable services.

Media

We perfect our quality standards to deliver services of the highest degree.

Featured In

The Benefits Of Starting A Business In Netherlands

The Netherlands is known worldwide for its beneficial environment for entrepreneurs. Many global investors and entrepreneurs consider starting a business in the Netherlands. In this guide, we explore the Netherlands as a jurisdiction to start a company. Here are some of the benefits of establishing a business in Holland:

- A corporate tax rate of 19%, which is among the lowest in Europe

- No value added tax (VAT) for transactions between member states of the EU

- Forbes rated the Netherlands as the 4th best country in the world for businesses

- The Netherlands has recently attracted many businesses and multinationals from the UK regarding Brexit

- The #1 country worldwide for double tax avoidance treaties

- The Netherlands is among the founding members of the EU

- Local companies have a great reputation in global commerce. The Netherlands has a big advantage in representation

- A staggering 93% of the entire Dutch population speaks English, and many are proficient in German and French as well. The Dutch are ranked number one worldwide when it comes to English proficiency, with English being a second language

- Highly educated labor force (3rd in the global top regarding education level)

- Outstanding international business atmosphere

- Holland is 4th in the global report of the WEF and first in the European top 10 for most innovative and competitive economies

- According to a recent investigation by G. Thorton, starting a business in the Netherlands is one of the best choices for foreign investors

- The country welcomes foreign entrepreneurs and investors, from small enterprises to multinational companies included in the Fortune 500 list

- The Netherlands attracts international companies from all sectors with its stable legislation and politics, coupled with excellent international relations

These are just some notable factors that contribute to the Netherlands being a profound hub for foreign entrepreneurs, investors and multinationals. Nonetheless, small and unique foreign companies are very welcome as well. If you have an original business idea or plan, your chances of success are quite substantial in the Netherlands.

Procedures To Follow To Gain Dutch Citizenship

EU, EEA and Swiss citizens

Non-EU citizens

Which Visa-Permit Do You Need To Live In The Netherlands?

Start-up permit:

Self-employed permit:

Starting a company in the Netherlands: all available Dutch legal entities

When you establish a business, you always have to pick a specific legal entity that fits your preferences and ambitions. In the Netherlands, you can choose from a wide variety of legal business entities. There is a significant distinction between unincorporated business structures (‘rechtsvormen zonder rechtspersoonlijkheid’) and incorporated business structures (‘rechtsvormen met rechtspersoonlijkheid’). The main difference between these two is that there is no distinction between your private and business assets in an unincorporated business. So if you create debts with your business, you can personally be held accountable. If you choose an incorporated business, you separate private and business assets and thus enjoy protection from business debts in most cases.

There are four types of unincorporated business structures:

- Sole proprietorship (Eenmanszaak or ZZP)

- Limited partnership (Commanditaire vennootschap or CV)

- General partnership (Vennootschap onder firma or VOF)

- Professional partnership (Maatschap)

There are six types of incorporated business structures:

- Private limited company (Besloten vennootschap or BV)

- Public limited company (Naamloze vennootschap or NV)

- Cooperative (Coöperatie)

- Mutual insurance society (Onderlinge waarborgmaatschappij)

- Foundation (Stichting)

- Association (Vereniging)

Legal requirements differ between the business structures, and there are also quite extensive differences in general requirements for establishment, the way you pay taxes, and the structure of each legal entity. In general, the business structure that is most often chosen by foreigners is the Private limited liability company (Dutch BV) due to the several practical and tactical benefits of this legal entity. If you would like personal advice about the best legal entity for your (future) business, Intercompany Solutions is always ready to assist you with any query you might have.

Starting a business in the Netherlands:

some regularly chosen company types explained

The Dutch BV is by far the most popular and, therefore, the most chosen legal entity. More than 90% of our clients choose the BV, in the Netherlands, around 65% of all legal entities are BVs. Nonetheless, there are also other company forms that might better suit your business goals. If you would like to enter into a partnership, for example, or if you would like to hire a common office space with other entrepreneurs within your field of expertise, such as a GP practice, notaries, or something similar. We will outline the most commonly chosen alternative legal entities below.

The Dutch Foundation

Dutch BV company

Dutch NV company

Branches and subsidiaries

General partnership

Professional Partnership

The Dutch BV and NV: differences between the two limited liability companies

Quick fact: Around 99% of our clients choose a Dutch BV company for incorporation. The Dutch BV is by far the most beneficial legal entity, unless you want to be publicly listed (NV) or you are looking to form a charitable foundation (stichting). The Dutch BV is likely the type of company you are looking for.

BV or NV: how do you choose which legal entity is best for you?

Potential clients often ask us which legal entity is the best fit: the BV or the NV? The BV is comparable to a private limited liability company, which means that the owner's liability is limited. Some comparable structures are the ‘Private limited liability company’ in the UK (Ltd), the French ‘Société a responsabilité limitée’ (SARL) and the German ‘Gesellschaft mit beschrankter Haftung’ (GmbH).

The NV is comparable to a corporation. The NV is also the legal entity that is able to trade shares at stock exchanges. In the UK, the NV is comparable to the ‘Public limited liability company’ (Plc), in Germany to the ‘Aktiengesellschaft’ (AG) and in France to the ‘Société anonyme’ (SA). If you want to decide which legal entity suits your needs best, you will need to compare some characteristics of both options and see which one matches your preferences. Below you will find a summarized comparison of the Dutch BV and NV, stating the most important distinctions between both entities.

The Dutch BV

The BV is a privately held Dutch legal entity comparable to a ‘private limited liability company’

- Practically no minimum capital is required

- Issued and required paid-up capital is determined by the founders, this is registered in the articles of association

- Different types of shares allow varying voting and dividend rights, plus non-voting shares

- Particular class shares may limit profit sharing entitlement, however such shares must always have voting rights

- Transfer restrictions are sometimes allowed

- Shares are not admitted to the stock exchange

- There is an annual general meeting (GM) for shareholders

- A one-tier board and a two-tier board are both possible

- A supervisory board (or non-executive directors in the board) is optional

- The articles of association can contain regulations granting shareholders limited possibilities to give general instructions to the management board

- The director or board decides about profit distribution

The Dutch NV

The NV is a public Dutch legal entity comparable to a ‘public limited liability company’

- The minimum capital is EUR 45,000

- Different types of shares are allowed (such as bearer shares)

- All shareholders receive voting rights as well as profit rights

- Transfer restrictions are sometimes allowed

- Shares are admitted on stock exchange

- There is an annual general meeting (GM) for shareholders with and without voting rights

- A one-tier board and a two-tier board are both possible

- A supervisory board (or non-executive directors on the board) is generally optional

- The articles of association can contain regulations granting shareholders the right to give specific instructions to the management board

- The GM decides about profit distribution

- If a certain contribution might threaten the continuity of the company, the management board may refuse approval for the distribution of profit, dependent on the outcome of a liquidity test

- Interim dividends are possible

Ready To Start Your Company?

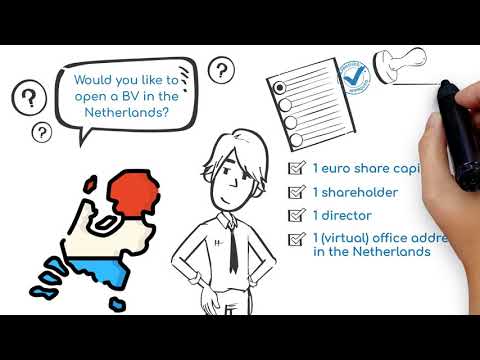

The Dutch private limited liability company (Dutch BV) in depth

Shareholders

A Dutch private limited liability company is established by at least one incorporator, which can either be a legal entity or an individual. The entity or individual, resident or foreign, can act both as an incorporator and a complete management board for the new company. A noteworthy fact is that a Dutch BV can be registered entirely remotely by the director(s) and shareholder(s), making it easier for foreign entrepreneurs to establish a Dutch BV.

It is also not mandatory to have a secretary. If there is only one shareholder, this does not result in personal liability, since the point of a limited liability company is the absence of personal liability for any debts made with the company. Still, the name of the shareholder will appear on the registration certificates of the company prepared by the Dutch Chamber of Commerce. Shareholdings are recorded in the register of shareholders maintained at the company’s office.

Incorporation deed

To start a business in the Netherlands, an incorporation deed is drafted in the presence of a public notary and submitted to the Trade Registry at the Dutch Chamber of Commerce and to the Tax Office. The official incorporation deed must be prepared in Dutch (our company will also prepare an English version of the notary deed for your convenience). This document lists the details of incorporators and initial board members, their participation amounts and payments made to the starting equity.

The deed also contains the AoA (Articles of Association) that include, as a minimum, the following details: the full company name, the location of the registered office in the Netherlands, the company purpose, the amount of authorized capital (EUR), the share division and relevant share transfer conditions.

Company name

Intercompany Solution will check, before we establish your Dutch business, whether the chosen company name is not already in use as a trademark or a commercial name. This is done because the holders of prior registrations have the right to that name and using it would entail copyright infringement. The name of your company must either end or begin with ‘BV’. In addition to the company name, a BV has the freedom to choose one or several trade names to label the business or secular parts of it.

Shares and share capital

The ones who incorporate can decide on the amount of share capital, only a minimum share capital of €1 is required. This used to be EUR 18,000 in the past, but since the start of the Flex-BV, there is no real minimum anymore. A single share with a corresponding voting right is required as a minimum. Shares can have profit and/or voting rights, sometimes a share will have profit rights but no voting rights, and vice versa. Dutch private limited companies can have corporate directors and shareholders.

Timeframe

The incorporation procedure to start a business in the Netherlands will usually take 3 to 5 working days. The timeframe depends on how complex the shareholding structure is, and, also, on the prompt provision of papers by the client. The sooner we have all the documentation we need, the easier it will be to establish your business in a timely manner. If you can acquire all documents in one day, sometimes the registration procedure takes only 2 business days.

Advantages of opening a BV in the Netherlands

There are several well-known advantages to owning a Dutch BV, which is exactly why almost all our clients choose to establish this specific type of Dutch company. The limited liability part is, of course, one of the main reasons why entrepreneurs choose this legal entity. But the BV has multiple beneficial characteristics. We will outline the most obvious advantages shortly below.

Limited Liability

Competitive income tax rates

The Netherlands benefits from a low corporate tax rate compared to some neighboring European countries. Also, when you have a sole proprietorship, you pay income tax on the profits. The highest tax bracket in this category is currently 52%. You also pay tax on the profits of a BV, but this is only 19% or 25.8%, depending on whether your profits exceed the total annual amount of 200,000 euros. Keep in mind, though, that you will still need to pay income tax on the profits you distribute to yourself. You can also pay yourself dividends, which could be more profitable in some situations. We have covered the topic of paying yourself dividends extensively in this article.

The minimum share capital required is extremely low

Innovation and subsidies

There are several interesting financial arrangements for entrepreneurs, such as (foreign) entrepreneurs who want to grow quickly and entrepreneurs with highly innovative concepts and ideas. Next to that, the Dutch government is making extra money available for innovative SMEs and for important research for future generations through the Future Fund. The government has already released €5 million annually for this purpose since 2018. The Future Fund started with €200 million. Then there is the WBSO, which is a tax scheme for research and development (R&D), and the Innovation Box instrument. Companies can reduce the financial burden of research and development (R&D) projects through the WBSO.

Dutch innovative top sectors are among the best in the world. These are sectors in which the Netherlands excels internationally. The government also actively invests in these top sectors:

• Top sector Horticulture and propagation materials

• Top sector Agri & Food

• Top sector Water and Maritime

• Top sector Life Sciences and Health

• Top Sector Chemistry

• Top Sector High-Tech Systems & Materials

• Top Sector Energy

• Top sector Logistics

• Top sector Creative Industry

No taxes on interest and royalties

Option to reinvest your profits tax-free via dividend payments

A professional impression

Two important reasons to incorporate a BV holding structure

The participation exemption for international companies

The international subsidiary’s profit is subject to taxation in the country where it is established. The profit after tax can then be transferred to the parent company in the Netherlands. This amount, received by the parent company, will not be subject to corporate tax in Holland, and thus, double taxation is avoided.

When Should I Consider Starting A Holding Structure For My Netherlands Business?

Company formation in the Netherlands: the procedure

In order to establish a Dutch company, you will obviously need to fill out the necessary paperwork. The required documents for the formation of a legal entity consist of a legalized copy of valid identification and proof of address. These documents need to be sent with an apostille, which you can obtain at a local notary’s office. Also, a power of attorney is required, which must be signed by a notary for remote formation. Please note, that it is currently not necessary to travel to the Netherlands when you want to establish a Dutch business: the entire process can be executed remotely. All involved shareholders may authorize us to take care of all mandatory filings on their behalf. Other necessary actions, such as applying for a bank account for your company, may also be performed remotely. Only in rare cases does the director need to be present, but this depends entirely on the bank you choose. If this is your preference, we can advise you on practical matters such as these because, in principle, every step can be done remotely.

The whole procedure of company formation in the Netherlands can be completed in only 3 to 5 business days, assuming all the documentation you send in meets the requirements. The largest portion of time is spent on the verification of the documents. Thus, it is very important that you make sure that you send us the correct documentation and what you send is complete.

The procedure for the formation of a Dutch BV is as follows:

Step 1

Step 2

Step 3

What are the costs of starting a business in the Netherlands?

The exact costs of incorporation will be calculated according to your specific business needs and goals, but you should consider the following standard fees and costs involved with the procedure:

- Preparing all legal documents and documents for identification purposes

- The fee at the Dutch Chamber of Commerce for registering a Dutch company

- The costs for registration at the local tax authorities

- Our incorporation fees cover the formation of the company as well as extra services such as the application for a Dutch bank account

- Our fees for assisting you with the VAT number and optional EORI number applications

- The annual costs cover our accounting services.

The total amount depends on several factors, such as the type of business you wish to establish, the amount of people involved, the amount of companies, and other details that influence the costs. Of course, we will happily provide you with a detailed personal quote for the formation of a Dutch company.

Company formation in the Netherlands timetable

Taxation of companies in the Netherlands

Every Dutch business is subject to taxation, of course. As an entrepreneur, you will have to pay several different taxes on all profits of your company. Currently, the corporate tax rate is 19% up to an amount of €200.000 profit annually, and all profits above this threshold are taxed at 25.8%.

Profits taxation

The Dutch VAT rates are:

9% lower VAT rate

0% tax-exempt rate

0% for transactions between EU countries

You can read more in-depth information about Dutch VAT in this article.

Tax Advantages And Obligations

After incorporation, private limited liability companies are registered at the Dutch Tax Authorities and as such, the required tax numbers are issued. All Dutch companies have particular obligations and need to submit different tax returns. Next to standard obligations, there are also some advantages, like the participation exemption that we have already mentioned earlier in the article. Another advantage is the possibility of paying yourself dividend. We will outline some standard Dutch tax obligations and advantages below.

Dutch corporate tax

Dutch income tax

Periodical tax obligations

Tax treaties with many other countries

As we already briefly discussed above, the Netherlands has many tax treaties with international countries. This entails EU member state countries, as well as countries outside of the EU zone. If you are already active professionally in your home country, it’s wise to seek advice regarding the country in which you should pay certain taxes. You are not supposed to pay tax on your income or assets more than once, which is why the Netherlands has tax treaties with a large number of countries. A tax treaty states which country may levy tax on your income. You have to deal with tax treaties if you live or work outside the Netherlands or if you do business abroad. If there is no tax treaty, the Decree on Prevention Double Tax 2001 applies. This decree states how the Netherlands will prevent double taxation if there is no tax treaty. This applies, for example, to incomes from developing countries. Most treaties cover double taxation and also include straightforward guidelines as to how you should arrange your tax return. This shields you from paying some taxes twice or even triple, depending on where you do business.

Dividend instead of salary

Economic Opportunities In The Netherlands

Due to the strong Dutch trade mentality as well as a solid transportation infrastructure, the Netherlands has been able to maintain a consistently high position as the largest economy in the world. The Dutch workforce is well-educated and fully bilingual, providing many possibilities regarding recruitment and doing business with other cultures. These factors and the substantially low costs for company formation make the Netherlands extremely attractive compared to other Western European countries.

Value Added Tax (VAT) In Holland

Holland uses a VAT system, similarly to other EU members. In Dutch, the abbreviation for VAT is Btw (belasting toegevoegde waarde). Some transactions are not subject to value-added tax, but it is commonly charged by the authorities. The regular rate, 21%, is charged with respect to almost all services and goods offered by Dutch businesses. This rate might also apply to products imported from non-EU countries. In the Netherlands, there is also a lower VAT rate of 9% regarding specific services and goods, e.g., medicine, food, art, medicine, books, antiques, entry to sports events, museums, theaters and zoos.

What does Dutch VAT mean for international entrepreneurs? When your company is established in a foreign country, but you are also operating in the Netherlands, you will need to conform to the national regulations. If you are offering products or services in Holland, in most cases, you will also need to cover VAT there. Then again, VAT is often charged in reverse to the individual receiving the product or service, resulting in a 0% rate. Reverse-charging is an option if your clients are legal entities or entrepreneurs established in Holland. Then you can omit the VAT from the invoice and insert reverse-charged instead. In all other cases, you need to pay the tax in the Netherlands. Starting a company in The Netherlands will allow your business to take full advantage of the Dutch VAT regulations.

The 30% tax reimbursement ruling

Another interesting tax advantage is the so-called 30% tax reimbursement ruling. When international employees are hired in the Netherlands, they can benefit from this tax exemption. If they meet certain conditions, the employer will transfer 30% of their wages to them free of taxation. This allowance is meant to compensate for the additional expenses of employees who work outside of their home countries. This can be very interesting for foreign expats, individuals who wish to work for someone from their home country, or otherwise internationally oriented employees. There are some eligibility conditions, of course. In order to qualify for reimbursement, candidates have to meet the following requirements:

- The employer is registered with the Dutch Tax Authorities in the Netherlands and covers payroll tax

- There is a written agreement between the employee and the employer that the reimbursement ruling applies

- The employee is either transferred or recruited abroad

- Upon hiring, the employee had resided more than 150 kilometers away from the border of the Netherlands for at least 18 months during the past two years

- The yearly salary of the employee is equal to or exceeding €37.000

- The employee has qualifications that are scarce on the Dutch labor market, which partly explains the advantage that national employees do not have.

The Netherlands compared to other countries

One main benefit of establishing a business in the country is direct access to the European Single Market. The Netherlands isn’t just a member state of the EU; it is actually held in very high regard by the other member states due to its stable political, fiscal and economic climate. The Dutch are often at the forefront of innovative concepts and ideas. As an entrepreneur, you can reap many benefits from being physically present in the country. The port of Rotterdam connects your business directly to the entire world, next to Schiphol Airport. The location of the country is excellent for any import, export or general logistics business. Furthermore, the Dutch tax rates are being further reduced. The goal is to achieve a strengthened investment climate, providing foreign investors with better opportunities. There has probably never been a better time to start a business in the Netherlands.

Intercompany Solutions in the Brexit report

We continually perfect our quality standards in order to deliver services of the highest degree.

Some Of Our Recent Clients

Frequently Asked Questions

On Business In The Netherlands

We receive many questions on a regular basis about company establishment in the Netherlands. Therefore, we have compiled the most frequently asked questions for your convenience. If you have a question that is not mentioned in this section, please feel free to contact us with your query anytime.

Procedure and requirements

The establishment procedure and corresponding requirements

How many days does it take to start a business in the Netherlands?

Is it mandatory to have a Dutch company address?

What is the minimum required share capital to establish a Dutch BV?

What is the procedure for starting a company in the Netherlands?

1) Drafting and submission of the deed of incorporation

2) Registration in the Dutch Chamber of Commerce

3) Tax registration

4) Bank account application

If you wish to obtain a permit or visa or would like us to take care of extra services, there will be more steps involved.

Which documents are necessary to establish a Dutch business?

Is it possible to start a business in international trade through a company in Holland?

Questions about the Dutch BV

Can you provide further information on Dutch BVs?

What kind of taxes do companies pay in Holland?

Can you list the main legal aspects of company establishment in Holland?

• Your company’s name must be available and comply with the laws

• You need a local office or virtual registration address

• You need to meet the requirements for registration

• You need to obtain the relevant business permits whenever they are necessary

Feel free to contact Intercompany Solutions for tailored business advice and a clear quote.

What are the available company types in Holland?

The entity preferred by most foreign investors is the private limited liability company, known as the Dutch BV. Other popular types are the foundation (stichting), the public limited liability company (NV), the cooperation, the general partnership, a collaborative entity and the sole proprietorship. If you are doubting about the best legal entity to suit your needs, you can find more information about company types on the website of the Dutch Chamber of Commerce, or contact us directly for professional advice.

Do I have to obtain any special licenses or permits for my newly established Dutch company?

Visa and Citizenship

Is a visa necessary to enter the Netherlands? What is the procedure for obtaining such a visa?

EU residents are free to enter the Netherlands without any specific documentation. Non-EU citizens can stay in the country with a Schengen Visa (short-term) for no more than 90 days. For longer stays, you must apply for a visa at the Dutch Embassy in your country of residence. You can visit the website of the Dutch Immigration and Naturalization Service for in-depth information about visas, how to obtain one, and the necessary requirements to do so.

What is the procedure for obtaining Dutch citizenship?

Legal questions

Can you list the main legal requirements that foreign entrepreneurs must meet in order to make investments in the Netherlands?

Can you explain the requirements for employment in Holland?

How do I register a brand or a trademark?