Frequently Asked Questions

1. Can I start a company in the Netherlands if I am not living there?

Yes, citizens of all countries are allowed to register companies in the Netherlands. We even have procedures to register a company remotely.

2. Do I need to have a Netherlands business address?

Yes, the company must be registered in the Netherlands, it is also possible to set up a branch or representative office of a foreign company.

3. Is there a minimum share capital in the Netherlands?

No, there is no longer a minimum share capital for the Dutch limited company. The official minimum is €0,01 for 1 share (or €1 for 100 shares). But it is recommended to make the share capital somewhat higher.

4. Do I need to have a local Dutch director?

A foreign entrepreneur, who starts a small- or medium-sized company in the Netherlands, in most cases will be the director of the new company himself. This is also the case for foreign entrepreneurs that do not live in the Netherlands. By Dutch law, it is fully allowed for a foreigner to be the owner and director of a company.

Lately, substance requirements are becoming more important. For example, for requesting a local VAT number or local bank account.

For the corporate income tax, the substance requirements may play a role. Especially if you have any specific tax treaties that are very important for your business, you should consider the substance requirements with your local tax advisors. In this case, a local director or staff can play a role for your tax status.

1. How does the process of incorporation work if I am not a resident in the Netherlands?

We are specialized in this type of company formation procedure. We can form the company remotely with video legalization. That means you won’t have to travel to The Netherlands.

2. How long will the incorporation take?

Generally it takes around 5 working days after we have received all your documents until the company is formed.

3. Can I be the shareholder and director (as a non resident)

Yes, the Dutch law requires 1 director and 1 shareholder. The director and shareholder can be the same person. There is no requirement for being a resident in The Netherlands.

4. What do you need to start?

We ask for a intake form, your desired company name and activity, as well as your ID document and proof of address.

1. Is it easy to obtain a business visa in The Netherlands?

It is very different case by case. We work closely together with an immigration lawyer. An intake consultation is possible from €250.

2. Do I need a business license in The Netherlands?

In general we do not work with business licenses in The Netherlands.

Generally only regulated industries such as: Energy, Healthcare and Financial sector have business licenses.

3. Why make a company in The Netherlands?

The Netherlands scores extremely high on all international business rankings, most of the country speak English and The Netherlands has one of the highest educated workforces in the world. See our videos and download our brochure below for more information.

4. What is the corporate tax rate in The Netherlands?

The corporate tax rate is 15% corporate tax for any profit until €395.000. And 25,8% for profit above €395.000.

Explainer video

How to start a business in The Netherlands - Explainer Video

Company Types in The Netherlands - Explainer Video

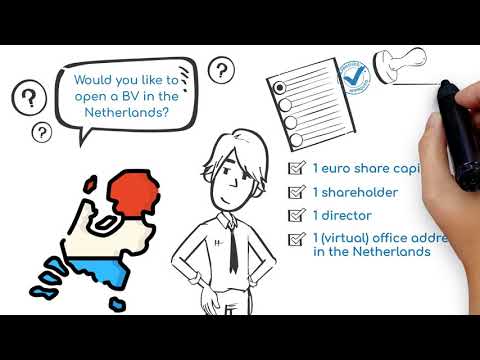

Would you like to open a BV in The Netherlands - Explainer video