Famous for its welcoming and dynamic atmosphere, the Netherlands attracts young people who wish to study or try their luck at starting up a business. Investors planning to open start-up companies in the country need a residence permit in order to do so. The document is issued if certain conditions are fulfilled. The application is submitted to the Immigration and Naturalization Service (IND) for approval. International residents interested in immigrating to the Netherlands may ask for assistance before starting the procedure.

Application requirements for a Start-up Visa

The general conditions related to the application for a start-up visa include possession of a valid document for travel, no criminal background and performed tuberculosis test (the test is not obligatory under particular circumstances).

The applicant must also have a Dutch “facilitator” (business mentor) in order to obtain a start-up visa/residence permit. The details about the cooperation between the applicant and the facilitator must be discussed in advance and the parties have to agree on the terms in written (by signing an agreement). Additionally, the applicant needs to offer an innovative service or product, have a detailed start-up business plan, be financially capable of living in the country and finally, complete the registration procedure at the Dutch Commercial Registry (the mentor must also have a registration).

The business mentor or facilitator must also meet particular conditions to qualify as such. Our consultants are familiar with the Dutch law on immigration. They can explain to you the conditions prior to the submission of the application and prepare the necessary documents. Any papers in a language different from Dutch, German, French or English need to be translated.

Procedures after application for a Dutch Start-up Visa

Entrepreneurs planning to open local businesses often have to be present for longer periods and therefore need a long-term visa. You can simultaneously apply for this document and the permit for a residence. If you meet the specified conditions, you will obtain the visa for start-ups within a period of ninety days from the submission of your application. You have to collect your residence permit no later than fourteen days after your arrival in the Netherlands.

Our local experts on immigration can give you more information on the process of application for a start-up visa. If you are planning to immigrate, be aware that you must take out a health insurance and register at the municipality. If you need detailed information on the possibilities to obtain Dutch residence as an owner of a start-up business, contact our specialists in immigration.

Read here if you are looking for information on the Dutch self-employed visa.

Legal residence / short stay visa's

Legal residence is always the basic requirement for working in the Netherlands, which may mean obtaining a residence permit, and often also an entry visa/permit.

The law on residence differs for EU/EEA citizens and those of other countries.

Citizens of EU states, Iceland, Liechtenstein, and Norway (known as the European Economic Area states, EEA) and Swiss citizens do not need a residence permit to enter, stay, live and work in The Netherlands. Passport or ID card are sufficient proof of rightful stay.

Citizens of other countries intending to stay longer than 90 days usually need an entry permit, (MVV), and a residence permit, issued by the Dutch Immigration Authority, IND, (Immigratie en Naturalisatie Dienst), the authoritative source on residence permits.

Non-EU/EEA or Swiss nationals, who want to stay in the Netherlands for more than three months will typically require a Dutch residence permit. Unless exempt, an entry permit (MVV) is also required, as well as an integration exam beforehand.

You do not need an MVV if:

you (or a close relative) are from the EU/EEA/Switzerland;

you already hold a valid Dutch residence permit;

you already hold a ‘long-term residence permit EC’ issued by another European Community (EC) state;

you already hold a residence permit in another country that is part of the Schengen area;

you already hold a residence permit/Blue Card for 18 months in another EC state;

you are a national of Australia, Canada, Japan, Monaco, New Zealand, South Korea, the United States of America or the Vatican City;

your child (under 12) was born in the Netherlands and you have lawful residence in the Netherlands.

You apply for a provisional residence permit in person at a Dutch embassy or consulate in any country, as long as you have lawful residence in that country. With just a tourist visa, you do not qualify as a lawful resident.

You can apply for the MVV and residence permit in a single application via the Entry and residence Procedure (TEV).

If you are exempt from the MVV requirement, you or your sponsor can apply for a residence permit while you are still abroad, or you can opt to apply for your residence permit once you are already in the Netherlands.

Within 90 days of your arrival in the Netherlands or any country in the Schengen area you must apply for a residence permit. After 90 days you need to have a residence permit, or you must have applied for a residence permit. If not you will be in the Netherlands illegally.

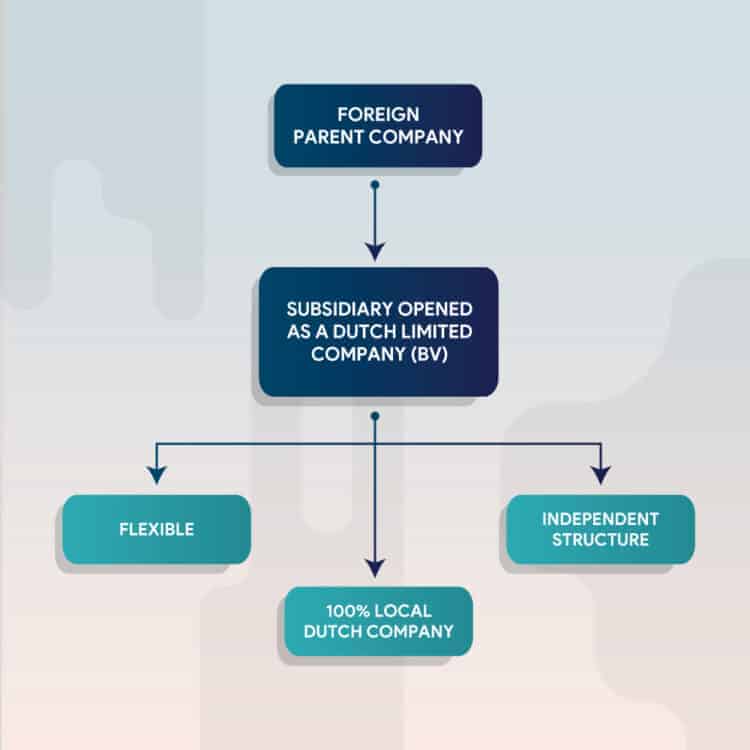

At Intercompany Solutions, we specialize in Dutch company formation. By far, the largest amount of our clientele chooses to establish a Dutch BV, which is the equivalent of a private limited liability company. The Dutch BV has many advantages and tax benefits that appeal to a wide audience, hence the fact that more than 90% of our clients incorporate a BV or BV holding structure. Nonetheless, the Dutch NV can also be a viable option, especially if you want your current company to go public. The Dutch NV is comparable to the public limited liability company, which issues shares via the stock exchange. But that is not the only noteworthy feature of a public limited liability company: there are several other characteristics that might be to your liking as an entrepreneur. We will discuss the Dutch NV extensively in this article, including the incorporation procedure and why this legal entity might be the right company type for your (future) Dutch business.

What is a Dutch NV?

NV is the abbreviation of “Naamloze Vennootschap”, which is a type of company with limited liability. There are broadly two general types of limited liability companies, namely the public limited liability company and the private limited liability company. The NV is comparable to a globally recognized public liability company. The core characteristic of such companies is the fact that you, as an individual, are not personally liable for any financial issues that might arise within the company. This means that when you create debts, for example, creditors cannot go after your personal assets and funds. Only in the case of serious improper management or fraudulent behavior that can be proven can creditors hold you responsible. This is also the main reason that these legal entities are so popular: they substantially limit the amount of risk you take with your business. If you plan to incorporate an NV in the Netherlands, you will first need to understand the general features of the legal entity. NVs are most suitable for investors who plan to raise public capital. Most importantly, the minimum required share capital amounts to 45,000 euros, of which no less than 20% has to be issued. This basically means that the NV is not appropriate for everyone. Another key feature is the fact that you can issue shares on the stock exchange, which is the definition of a public company. We will discuss all these features in more detail below.

Why incorporate a Dutch NV?

There are many reasons one would like to incorporate a public limited liability company. Often, private limited liability companies (in Dutch also known as “Besloten Vennootschap”, or BV) achieve success at some point, which leads to going public. You might also own a successful foreign public limited liability company, which you would like to expand to the Netherlands or even convert into a Dutch business because this might be a fruitful decision for you. The Netherlands is among the top business destinations for international investors because of its stable economy and open policies with respect to commerce and investments. The country is annually listed at the top of many renown business indexes simply because the business climate is very healthy and international trade is encouraged due to the country's strategic position. This has already led to many well-known international corporations settling in the Netherlands; some have even established their headquarters here because of the fantastic infrastructure. Therefore, it is a wise decision to open a Dutch NV company if your aim is to expand with a public company internationally. Local businesses have the advantage of a flexible tax regime that allows corporate tax exemptions for income from capital gains and dividends. Next to that, the corporate income tax in the Netherlands is relatively low when compared to neighboring countries, another benefit that might help your business skyrocket.

Some general facts about the Dutch NV

The public limited liability company is a legal form that is actually not very common in the Netherlands. There are approximately 2,500 companies that use the public limited company as a legal entity, which mainly consist of very large companies. What exactly does a public limited company encompass? A public limited liability company is, as the term suggests, a certain type of company where the identity of the shareholders is not necessarily known to the public. This is due to the free tradability of shares on the public market. The distinguishing feature of an NV compared to other business forms is its free tradability. A public limited company is a legal entity and is very similar to a private company. Just like with a Dutch BV, you are employed by the company as a director. You usually set up a limited liability company with several people. All directors of the NV have the highest power and are also shareholders. Just like a BV, the capital of the company is divided into shares. The difference is that the shares of a public limited company can be transferred. Shares that are transferable and tradable on the stock exchange may be issued. Thus, NVs are often large corporations. This is because it is easier to raise capital (by issuing new shares) as a public limited liability company than as a private limited liability company.

Shareholders

So, the capital of an NV is raised by shareholders. The NV is a so-called capital company (as opposed to a partnership). The difference with a BV is that with an NV, the shares do not have to be registered (although it is possible), hence the term 'public limited liability company'. This means that shares are easily transferable. Any natural person who can literally show a share, although this no longer happens physically these days since everything is digitalized, is a shareholder. Therefore, he or she automatically shares in the profits and has a vote. So, in principle, the NV does not know who its shareholders are. Keep in mind that the NV is a limited liability company. Thus, the shareholders of the public limited company are not liable for any debts of the public limited liability company. They are only expected to contribute to the loss up to the amount that was originally paid for the share(s). The directors are also not personally liable for the debts of the NV. Only in exceptional cases can directors be held privately liable for the debts of the public limited company. This may be the case when there is director's liability or, for example, when the NV has not been incorporated correctly.

Structure

The basic structure of an NV includes a board of directors that takes care of the day-to-day management of the company, a General Meeting of shareholders (GM) that makes certain key decisions, and in many cases also a Supervisory Board to provide supervision and advice. The core idea behind the Dutch NV is that it provides both flexibility and protection to those who invest, without having to worry about personal liability. According to the law, the board must manage the public limited liability company, so the board is responsible for all daily affairs. Please keep in mind that the articles of association may grant certain directors different powers. The fact that the board is responsible for the day-to-day affairs of the NV also means in Dutch law that the shareholders' meeting may not give specific instructions about this but may only set general guidelines and provide advice on certain topics. The GM is also responsible for the most important decisions that the public limited liability company makes. The GM appoints the board of the NV, unless there is a two-tier board, decides on the transfer of (a large part of) the company to a third party, decides whether the company should enter into sustainable partnerships, and assists with acquiring or divesting a large shareholding in the capital of another company. The signing authority within an NV is strictly regulated. Depending on the articles of association and internal regulations, it is therein determined who may represent the NV and enter into binding agreements on behalf of the company.

The stock exchange listing: benefits and challenges

When an NV is listed on the stock exchange, it simply means that the shares are publicly traded on the stock exchange. This makes it possible for the public to buy and sell shares of the company, which is also why not all shareholders are always known. When listed, the NV must comply with strict regulations and transparency requirements set by the stock exchange. One of the biggest advantages of a stock exchange listing is the opportunity to raise significant capital by issuing new shares. However, it also brings challenges, such as the need to provide quarterly reporting, shareholder influence and market pressure on short-term performance. Please note that the listed company is a separate version of the public limited liability company. Another major advantage of a public listing for the company is that the shareholders can easily dispose of their shares in the NV if the value suddenly plummets. A disadvantage is the many additional requirements that a listed company must meet, such as a listing on Euronext. To acquire this listing, there must be numerous tradable shares, and the articles of association must meet certain requirements. In addition to the requirements that Euronext imposes on an NV, there are also additional legal requirements for a stock exchange NV. For example, a prospectus must be drawn up, which must, of course, also meet a number of legal requirements.

The differences between a private and public limited liability company (BV vs. NV)

If you are unsure whether to set up either a Dutch BV or NV, we generally advise starting with a BV. A BV has fewer specific requirements than an NV, to name just one simple example. Around 99% of our clients choose a Dutch BV company for incorporation. The Dutch BV is by far the most beneficial legal entity, unless you want to be publicly listed or are looking to form a charitable foundation. The Dutch BV is likely the type of company you are looking for. Nonetheless, we will outline some of the general differences and similarities between the two limited liability companies below.

The Dutch BV

- The minimum share capital is 1 euro

- Issued and required paid-up capital is determined by the founders, this is registered in the articles of association

- Different types of shares allow varying voting and dividend rights, plus non-voting shares

- Particular class shares may limit profit sharing entitlement; however, such shares must always have voting rights

- Transfer restrictions are sometimes allowed

- Shares are not admitted to the stock exchange

- There is an annual general meeting (GM) for shareholders

- A one-tier board and a two-tier board are both possible

- A supervisory board (or non-executive directors on the board) is optional

- The articles of association can contain regulations granting shareholders limited opportunities to give general instructions to the management board

- The director or board decides about profit distribution

The Dutch NV

- The minimum capital is EUR 45,000

- Different types of shares are allowed (such as bearer shares)

- All shareholders receive voting rights as well as profit rights

- Transfer restrictions are sometimes allowed

- Shares are admitted on the stock exchange

- There is an annual general meeting (GM) for shareholders with and without voting rights

- A one-tier board and a two-tier board are both possible

- A supervisory board (or non-executive directors on the board) is generally optional

- The articles of association can contain regulations granting shareholders the right to give specific instructions to the management board

- The GM decides about profit distribution

- If a certain contribution might threaten the continuity of the company, the management board may refuse approval for the distribution of profit, dependent on the outcome of a liquidity test

- Interim dividends are possible

As you can clearly see, there are some notable differences between the two limited companies. For instance, a BV can only issue registered shares, whereas a NV can issue both registered and bearer shares. This is why we explained earlier that an NV doesn’t always necessarily know who its shareholders are. The articles of association determine a large part of the rules regarding the possibility of transferring shares freely in a BV. Oftentimes, there are certain transfer restrictions that limit some (or all) shareholders. In that case, the other shareholders need to give their consent when a shareholder wants to transfer shares. Also, the other shareholders have a preemptive right to buy shares from a selling shareholder. Next to that, in 2012, the Flex-BV was introduced. One of the most notable changes was the decision to cancel the obligation to bring in a minimum share capital in order to start a BV. This makes a BV much more accessible to the public since not everyone has sufficient assets to pay the share capital of 45,000 euros for the NV. For most companies, a BV structure is the best option.

Benefits of owning a Dutch NV

There are some clear advantages to owning a limited liability company. For starters, an NV has a legal personality. It is therefore an independent legal subject that can be managed separately from its shareholders. This also explains the limited liability of directors and shareholders, since the company and the individuals associated with it are in fact separate entities. Dutch law also sees it this way. Next to that, it is relatively easy to attract resources to an NV company. By issuing shares, a public limited liability company can raise money, for example, to invest in its own growth and expansion. As opposed to a BV, the shares of an NV are freely transferrable. If the shares are listed on a stock exchange, they are relatively easy to trade. Lastly, in some cases, public limited liability companies can enjoy tax benefits, such as lower tax rates on dividend income for shareholders and deductions. Note that almost all these benefits also apply to the Dutch BV, apart from the freely transferrable shares.

Incorporators of a Dutch NV

The first stage in starting a Dutch NV is to establish the incorporators, or founders, of the company. These may be a single or multiple legal entities of any nationality residing anywhere in the world. If, for any reason, the founders are unable to stay in the Netherlands during the process of incorporation, a Power of Attorney is sufficient for their representation. This means we can set up your Dutch NV entirely remotely in most cases. To set up a limited liability company, there are a number of steps that need to be followed. Firstly, the founders must hold a statutory meeting in which they adopt the company's articles of association. These articles of association contain information about, among other things, the purpose of the company, the shares and the powers of the shareholders and management. A notarial deed must then be drawn up through a notary, in which the incorporation of the company is ratified. This deed must be registered in the trade register of the Chamber of Commerce, which is usually arranged by the notary. We will explain this step in more detail below.

The mandatory requirements to establish a Dutch NV

The mandatory requirements for opening an NV include a minimum of one shareholder plus established boards of supervisors and managers. Also, the company must have a local registered address. You can easily establish your NV on a so-called virtual address nowadays, just be sure that you acquire an address from a trusted third party. A Dutch NV company has freely transferable bearer shares, registered shares or share certificates and can repurchase 10% of outstanding shares at all times. NV formation requires the services of a local lawyer and a Dutch notary with experience in preparing and executing incorporation deeds.

Procedure for the incorporation of a Dutch NV company

According to Dutch law, a public limited liability company is established by drawing up a notarial deed. The articles of association (AoA) of the NV must be included in that deed, which must include the name, registered office and purpose of the company. A notary is able to execute the Incorporation Deed of the company containing the AoA. The term 'N.V.' or the term 'Public Limited Liability Company' must be placed before or after the name. Once the notarial deed has been drawn up, the Minister of Justice must still give permission to actually incorporate the NV. If an NV is being established for unauthorized purposes (such as money laundering or terrorist financing) or if the use of the NV will lead to disadvantages for creditors, the declaration may be refused. Establishing the NV is then not permitted. During the process of establishment, the company can already be added to the Dutch Trade Register as a company in formation (“i.o.” in Dutch). Once the public limited company has been established, it can carry out its activities without the i.o. indicator, which indicates that the NV is fully established. Carrying out daily activities includes making decisions and entering into legal contracts with third parties.

If these conditions are met, each founder must participate in the share capital of the public limited company. Everyone must therefore deposit money, with a minimum total amount of 45,000 euros. If there are multiple founders, this means that you can split the total sum between you all, which makes the initial financial transaction a bit more bearable. Finally, the public limited company must be registered in the Trade Register of the Chamber of Commerce, together with a number of other pieces of information about, for example, the costs of establishing the NV.

If the newly opened NV owns any registered shares, then it must also keep a register of shareholders. After the process of registering the company is completed, the notary shall prepare the register of shareholders to be maintained by the board in the official office of the company. Every shareholder is included with their complete name, address, type and number of shares, currency and issue date, amount of paid-in capital per share, pledges, and other hindrances. Also, if the above details change, then the registration should be updated. This is the responsibility of the board and its representatives.

Procedure for the registration of a Dutch NV in the Trade Register

An important step in the formation of a Dutch NV company is its inclusion in the Dutch Trade Register. The following documents are necessary for this registration procedure:

- a personal identity document

- a statement from the bank, no more than thirty days old

- a reference paper for a residential address or, alternatively, a copy of the contract for rent of the local property.

These documents are needed to receive a registration number that is unique to the company. Within a period of 8 days after successful incorporation, some of the company’s details need to be included in the registry at the Dutch Chamber of Commerce, located in the same district as the NV’s registered office. If you need more details on Dutch NV formation, please call our local incorporation agents. They will provide you with thorough information on the matter and offer you personalized advice depending on your case and specific requirements. We also assist with the incorporation of private limited companies in the Netherlands.

Frequently Asked Questions about setting up a Dutch company

Can non-residents form a company in the Netherlands?

Yes, a resident of any country can incorporate a company in the Netherlands. For your convenience, we also provide procedures for starting a business remotely. All you need is a valid form of identification, a preferred company name, and possibly some other official documents, such as a deed of incorporation of your current business if you want to establish a subsidiary in the Netherlands that falls under your current holding company. In almost all cases, it is unnecessary to physically travel to the country, as we can arrange every step of the establishment procedure remotely for you.

Can I be the shareholder and director (as a non-resident) of a Dutch NV company?

In a Dutch public limited liability company, ownership and control are typically divided between shareholders and directors. Like with a BV, the shareholders are the owners of the company. They own shares in the company, which represent their ownership interest. Shareholders can be individuals or other legal entities. In the case of an NV, there can be both registered and non-registered (bearer) shares. Non-registered shares mean that ownership is not recorded in the company's register, and the shareholder is not known to the company. The ownership of non-registered shares can be transferred simply by transferring the physical share certificates. Shareholders with non-registered shares can still be partial owners, but their ownership is not recorded in the company's official records. Next to shareholders, there are also directors. The directors are responsible for the day-to-day management of the company, and they make operational decisions. The shareholders, in turn, generally have the authority to appoint, dismiss, and supervise the directors. In summary, both shareholders and directors play essential roles in the ownership and management of a Dutch public limited liability company. Shareholders own the company through their shares, and directors manage the company's operations. The specific details can vary based on the company's articles of association and corporate governance structure. So, you can be both a shareholder and a director.

What do non-residents need for Netherlands company formation?

If you want to establish a Dutch company, you will need some basic documents and data to start the process. The first important necessity is a unique and original company name that resonates with your overall goals and ambitions. You will also need one or more founders of the company, since a company cannot establish itself. Next to these two basics, there is also a chance you might need permits, depending on the nature of the business you wish to incorporate. If you want to physically move to the Netherlands as an individual, you might also need a permit or visa, this depends on your country of origin. Intercompany Solutions can assist you professionally with all these matters.

Where can non-residents form a company in the Netherlands?

If you want to establish a Dutch BV, you will need an existing physical address for your company. This is required by Dutch law: your business needs to be incorporated within the country itself to qualify as a Dutch BV company. If you want to open a subsidiary for an already existing holding company, these same rules apply. There are many possibilities in this regard, such as hiring an office space at a strategic location. If you are opting for a logistics company, we suggest you pick a location next to an accessible travel route. The Netherlands houses the port of Rotterdam and the internationally well-known airport of Schiphol, which are never further away than a 2-hour drive from any location. If you want to hire staff, we suggest you pick a location that can easily be accessed via public and personal transportation. Alternatively, you can also opt for a virtual office if you don’t plan on being physically present in the country. There are many companies offering office space or simply a registration address, you can search for these companies via the internet. Make sure you choose a reputable partner. You can check any company in the trade register and look for customer reviews to be certain.

What type of company should I choose as a foreign entrepreneur?

It can be a difficult decision at first if you want to choose the proper legal entity in the Netherlands that best suits all your business needs. Since there are so many different legal forms, this can be a bit overwhelming for foreign entrepreneurs, especially when you are just starting out as a potential business owner. In general, almost all our clients choose the Dutch BV as their preferred company type, mainly due to the large amounts of (financial) benefits this company type offers. Next to that, the BV is nationally and internationally regarded as professional and trustworthy, which will make doing business for you much easier. The Dutch NV is a possibility if you want to go public with your company, which can provide you with additional benefits. Please note that the requirements for the establishment of a Dutch NV can be much stricter, though. Feel free to contact us for personalized advice regarding the best legal entity for you.

How much does Netherlands company formation cost?

The costs for company formation are not standardized, as every company is different and thus will require a variety of actions for incorporation. In general, you will need to take into account that there are registration fees, costs for a notary, possible translation costs for the deed of incorporation, the costs of opening a Dutch bank account, and the fee for our services. If your company requires certain permits, then these costs also need to be added. If you want to move to the Netherlands yourself, you will also have to add possible fees for a work permit or visa. Furthermore, if you require further assistance, there will be extra costs for additional services. We offer a standard start-up package of 1499 euros without any hidden fees or costs for standard procedures. Please contact us for a personalized quote if you want to be absolutely sure regarding the costs of Dutch company registration.

When are the fees due for Netherlands company formation?

There are several separate fees you have to take into account when establishing a Dutch company, such as the registration fees, the fees for the notary public, possible fees for extra services such as applying for an EORI number and a Dutch bank account, and of course the fees for the expert at Intercompany Solutions who will take care of the entire process for you. To streamline our processes and make sure your company is indeed incorporated within the promised 3 to 5 business days, we ask that you pay the costs for the incorporation package tailored to your needs upfront. We always provide you with a clear quote beforehand, so you know what the total amount consists of. Due to the very short timeframe of company establishment, this is the only way we work.

Are company formation expenses in the Netherlands tax-deductible?

All costs you have incurred for a company from a business perspective are deductible. This also includes costs incurred with the clear intention of setting up a business, i.e., the costs that you incurred before you started the business. These costs can vary enormously, such as the price for a market survey, obtained advice and general costs and fees, such as the notary fee when setting up a Dutch BV. Once you are considered an entrepreneur, you can, under certain conditions, deduct the VAT you have paid as input tax from your sales tax return. It is also possible for you to use the special arrangements for entrepreneurs for income tax purposes with retroactive effect. So, keep all invoices and also keep the correct administration, because that is the only way you will be able to file a VAT tax return.

What is the corporate tax rate in The Netherlands?

The current corporate income tax rate is 19% for all profits up to a total sum of 200,000 euros. If you generate an annual profit that exceeds this amount, you will have to pay 25.8% of the profits. This means the Netherlands has a relatively low corporate income tax rate when compared to neighboring countries. Please be informed that corporate tax is not the only tax you will have to pay. If you want to pay yourself a salary as a director, there will also be income tax involved. Next to that, you might have to pay tax on dividends that you pay out, although in some cases this can be tax-free under the participation exemption. If you hire staff, you will also have to pay income tax on their salaries. Please be sure to consult with a financial specialist if you want to comply with all tax laws and regulations. Intercompany Solutions can professionally assist you with this.

Which agencies are involved in Dutch company formation?

There are many companies that offer assistance with Dutch company formation. Intercompany Solutions is one of these companies. We offer you a very wide variety of expertise that we have built up over the years, combining extensive knowledge with practical experience. This enables us to take care of business very rapidly since we are personally acquainted with all the important players and organizations within the field.

If you are a foreign entrepreneur who wants to incorporate a Dutch company, then you should already be familiar with the private limited liability company. Not only are the majority of Dutch companies private limited liability companies, but 99% of our clients actually choose to establish this legal entity when incorporating a business in the Netherlands. The BV is a very versatile legal entity that offers the added bonus of limited liability for all directors and shareholders. This means that you cannot be held personally liable for any debts you might create with your company. But there are many more advantages to a Dutch BV, which are often unbeknownst to foreign entrepreneurs. As such, we receive a lot of questions about the Dutch BV. In this article, we answer the most commonly asked questions, so you can learn about all the benefits this company form has to offer.

1.What kind of entity is the Dutch BV?

In almost every country, there are several legal entities you can choose from when you establish a company. A legal entity is the business itself. As it has legal status, it is considered independent and able to enter into contracts, as if it were a person. Hence, it is named an entity. The Dutch BV is basically one of the many legal entities you can choose for your company in the Netherlands. It is also an incorporated entity, which means that it legally exists as such. The Dutch BV is the equivalent of a private company with limited liability, such as the German GmbH and the Ltd. company in the United Kingdom. Therefore, its shareholders are liable (financially) only for their own investments in the business and do not carry personal liability for the company’s debts. This is why, among other reasons, Dutch BVs are preferred by international entrepreneurs.

2.What are some general benefits of the Dutch BV?

The Dutch BV is the most popular legal entity for various reasons, such as the abovementioned limited liability it offers for its directors and shareholders. But that’s not the only advantage, on the contrary, the required minimum share capital is only 1 euro, which is generally divided between 100 shares. This used to be €18.000 in the past, but it changed with the introduction of the Flex-BV in 2012. One massive benefit of the BV is the possibility of establishing a holding structure in which one or more subsidiaries fall under one holding company. You can thus create the perfect company structure according to your preferences, and you also have the option to divide your property and financial risks among several BVs via a holding company structure. Furthermore, selling your company is fiscally attractive. With a private limited company, you can generally sell (part of) the shares at a very favorable price if you own a holding structure. If the holding company owns at least 5% of the shares of the working BV, the participation exemption applies. This tax rule ensures that the sale of shares is tax-free, which means you can invest it all in another company, for example.

The same applies to profits you generate, as there are ways to invest these tax-free as well. Another advantage of the Dutch BV is that you can easily attract investors through the issuance of shares. This provides investors with a certain amount of security, making them more amenable to investing. Additionally, the corporate income tax in the Netherlands is relatively low when compared to other neighboring states. As the owner of a BV, you benefit from this. Business succession with a BV is also easier than with other legal entities. Lastly, you generally make a great impression when owning a BV. Due to the incorporation requirements and strict fiscal regulations, owning a BV exudes professionalism and this will naturally draw customers and potential business partners towards your company.

3.Why form a BV company in the Netherlands?

The Netherlands is considered one of the top countries for business worldwide, which is proved by the country’s top position in many esteemed international business lists. One interesting fact about Holland is its fantastic strategic position. You will find both Schiphol Airport and the port of Rotterdam in the country, which are never more than a 2-hour drive away from your location due to the small size of the Netherlands. This is especially beneficial for companies that participate in import and export activities, such as logistics companies, web shops, wholesale companies and general trade companies. Next to that, the Dutch are very innovative and welcome foreign entrepreneurs with open arms. Diversity is high on the agenda, and the more interesting companies that settle in Holland, the better. The population is almost entirely bilingual, the Dutch are actually the best non-native English speakers in the world. Most Dutch people even know a third language, such as French or German. You will have no issue finding qualified personnel or freelancers to assist you with your business activities. The economic and political climates are generally stable, creating a safe haven for anyone who is serious about doing business internationally.

4.When should one consider forming a BV company in the Netherlands?

There are many imaginable reasons to establish a company overseas. If the current business climate in your own country is unstable, it is a good solution to consider expanding to other nations. The same goes for businesses that aren’t quite achieving the success you hoped for in your native country, whereas the same company might be very successful elsewhere. Also, you might just be looking to expand your company internationally to cover more ground or attain other types of clients and investors. Some countries might offer higher-educated staff, or more specifically, educated employees that specialize in something you need for your business. For all these reasons, the Netherlands is actually a great choice since it offers everything you might look for. Furthermore, the country is a member state of the European Union (EU) and, as such, has direct access to the European Single Market. Being able to freely trade goods and services between so many countries is a huge benefit for almost any type of company. So, if you would like to take your business to the next level, the Netherlands is an absolutely fantastic location to choose.

5.What are the top companies based in the Netherlands?

In 2020, more than 24 thousand multinationals were active in our country, according to the Dutch Central Bureau for Statistics (CBS)1. These include (but are definitely not limited to) well-known companies such as Discovery, Ridley Scott, Panasonic Europe, FUJIFILM Irvine Scientific, Swisscom, Universal Music, IKEA, Lipton, Nike, Adidas, Cisco Systems, Booking.com, Tesla Motors and Netflix; the list is extensive2,3. There are many reasons these companies decide to open a subsidiary or even headquarter here, such as the fantastic infrastructure, highly qualified staff, international opportunities and opportunities for growth and innovation. The Netherlands is globally seen as a very progressive country with a vibrant business climate that attracts many successful businesses. If you choose to open a Dutch BV, you will also be one of these entrepreneurs. This will undoubtedly professionalize your corporate image even further.

6.Can non-residents form a BV company in the Netherlands?

It is entirely possible for non-residents to open a Dutch BV; the Netherlands even welcomes foreign investors and entrepreneurs. The procedure itself depends on your specific preferences, such as the number of companies you would like to open, the number of owners/shareholders, the nature of your company and its activities, where you want to settle, and whether you would also like to immigrate to the Netherlands. In almost all cases, remote incorporation is fully possible, so there is generally no need for you to travel to the Netherlands. If you are able to provide us with all the necessary information and documents, we can arrange the entire process for you from here. Due to the possibility of remote establishment, almost any foreigner can start a Dutch company from their home country. As a side note, it also positively influences international trade and the image of the Netherlands as an inclusive country when many foreigners incorporate a company here.

7.Who is considered to be the owner of a BV, and can someone be both the shareholder and director (as a non-resident)?

The owners of the BV are its shareholders, who have acquired privately registered shares and thus own (part) of the company. There must be a minimum of one shareholder. A shareholder can be either a Dutch or a foreign, physical or legal, entity or natural person. If there is only one shareholder, the shareholder’s details are available to the public via the website of the Dutch Chamber of Commerce. If there are multiple shareholders, only the details of the BV’s directors are listed in the trade register. Please note that the directors of a Dutch BV are not necessarily shareholders, nor are shareholders always directors. This can vary, although the main director (directeur-grootaandeelhouder, or DGA in Dutch) is also always a shareholder. If you establish a Dutch BV by yourself, you will be the DGA and therefore the owner, as well as a shareholder and director.

8.Does a Dutch BV need a director?

Any private limited liability company should have a minimum of one director, although there is not necessarily any need to appoint a secretary. The director’s position can be filled by the single shareholder or by nominated directors. In principle, the director is the official representative of the Dutch BV under all circumstances, unless his/her powers are limited by the provisions of the Articles of Association or Memorandum of Association (AoA/MoA) or supplementary agreements with shareholders and managers. If you are starting a Dutch BV by yourself, you will automatically be the sole director. If there are multiple directors, then the BV has a board of directors, which is mostly referred to as "the board". Keep in mind that every Dutch BV needs to register its main director in the Ultimate Beneficial Owner (UBO) register.

9.What do non-residents need for company formation in the Netherlands?

If you want to establish a Dutch company, you will need to provide some basic documents and information to start the process. The first important necessity is a unique and original company name that resonates with your overall goals and ambitions. You will also need one or more founders of the company, since a company cannot establish itself. These founders need to provide a valid form of identification to start the process. Next to these two basics, there is also a chance you might need permits, depending on the nature of the business you wish to incorporate. If you want to physically move to the Netherlands as an individual, you might also need a permit or visa, this depends on your country of origin. Intercompany Solutions can assist you professionally with all these matters.

10.Do I need a business license in the Netherlands?

There is generally no need for a business license, except in very specific cases. Most types of companies can operate freely in the Netherlands without the need for any licenses or permits. If you would like to know if you need a license, you can check this website and fill in the data that is asked. You will immediately know whether you need a license or permit. In the case that you want to expand or renovate your factory or business premises, or place a facade advertisement, chances are high you will need an environmental permit. The environmental permit has been in existence since October 1, 2010, and replaces a number of permits and exemptions. In the past, you needed multiple permits for, for example, construction, felling, the environment, advertising and use. You apply for the environmental permit via the Online Environment Desk. Sometimes it turns out that your plans do not fit within the zoning plan. With an environmental permit, you can ask the municipality to deviate from the zoning plan. Also note that an establishment permit is no longer required. When deciding whether to grant the permit, the Dutch government checked if the entrepreneur had sufficient professional knowledge. This rule has no longer applied since July 1, 2007. So, you no longer need to apply for an establishment permit4.

11.How much does the formation of a Dutch BV cost?

The total amount you will need to spend depends on several factors, such as the type of business you wish to establish, the amount of people involved, the amount of companies, and other details that influence the costs, such as whether you would like to immigrate to the Netherlands and need a visa or certain permits. The exact costs of incorporation will be calculated according to your specific business needs and goals, but you should consider the following standard fees and costs involved with the procedure:

- Preparing all legal documents and documents for identification purposes

- The fee at the Dutch Chamber of Commerce for registering a Dutch company

- The costs for registration at the local tax authorities

- Our incorporation fees cover the formation of the company as well as extra services such as the application for a Dutch bank account

- Our fees for assisting you with the VAT number and optional EORI number applications

- The annual costs cover our accounting services.

Of course, we will happily provide you with a detailed personal quote for the formation of a Dutch company.

12. Are company formation expenses in the Netherlands tax-deductible?

All costs you incur for a company from a business perspective are deductible. This also includes costs made with the intention of setting up a business, i.e., the money you had to spend before you started the business. These costs can vary enormously, such as the price for a market survey, obtained advice and general costs and fees, such as the notary fee when setting up a Dutch BV. Once you are considered an entrepreneur, you can, under certain conditions, deduct the VAT you have paid as input tax from your sales tax return. It is also possible for you to use the special arrangements for entrepreneurs for income tax purposes with retroactive effect. This means that you should keep all invoices and also keep the correct administration, because that is the only way you will be able to file a VAT tax return. So, to answer the question, yes, the incorporation fees are almost always tax-deductible.

13.How much share capital do I need to deposit?

In October 2012, the government of the Netherlands passed a new act regarding the requirements for the establishment of BVs to stimulate entrepreneurship. The share capital necessary for incorporation was reduced from €18,000 to €0.01 per share, for a total of 100 shares, due to the introduction of the so-called Flex-BV. This means that the Dutch BV has been much more accessible to a wider audience since then, which also explains the large number of new BVs that have been established since that year. Our advice, however, is to start your BV with a minimum share capital of €100 and a nominal share value of €1.00 per share. If you would like to opt for a share value above €1000, please let us know, because in such cases, the procedure for incorporation will be a bit different and possibly slightly longer.

14.Where can non-residents form a BV company in the Netherlands?

Dutch BVs are all obliged to have a registered address in the country itself, meaning that the company needs to be physically present in the Netherlands. The address has to be real and physical, which means that P.O. boxes and other forms of postal addresses are not acceptable. You can rent an office space to achieve this, there are many kinds of office spaces available throughout the Netherlands. Alternatively, you can register your company with a third party that allows you to establish your company using an address they provide. Please do your due diligence in this case and make sure that this third party is trustworthy and offers legally sound services. Without a valid Dutch registration address, company establishment is impossible, so try to find a good location throughout the Netherlands that suits your needs well.

15.What is a holding structure, and what are its benefits?

If you want to establish a Dutch BV, you have several options. You can choose to incorporate a subsidiary, which is basically an operating company. All your daily business activities are carried out by an operating company. If you already own a parent company in your native country, you can link the Dutch subsidiary to your already existing holding company. Alternatively, you can choose to establish an entire holding structure in the Netherlands. You will then have a holding company as well as one or more subsidiaries, depending on your goals and personal preferences. One of the main benefits of a holding structure is risk spreading. You can move your assets around the BVs, for example, when you want a certain amount of profit to be safely stored. In the event that one of your subsidiaries goes bankrupt or when you sell it, you can deposit funds within the holding company, which will then be safe due to limited liability. You can also fund new ventures with money that is stored in the holding under beneficial tax conditions. Next to that, if your holding owns at least 5% of the shares of any given subsidiary, some activities fall under the participation exemption. This allows you to use profits tax-free. Please feel free to contact Intercompany Solutions if you have more in-depth questions regarding the holding structure.

16.What kind of obligations does a BV have towards the Dutch government?

Every Dutch private limited liability company is required by law to submit a yearly report and financial statements to the trade register of the Dutch Chamber of Commerce. Next to that, you will have to file annual and periodic tax returns. These also need to be filed on time if you want to avoid fines. If the company is categorized as a VAT-liable company, it is therefore obligated to submit a VAT declaration quarterly too. If you have employees, you will be responsible for payroll activities. External audits are required when two out of the three following conditions are fulfilled: the BV’s annual turnover is above 12 million euros, its total balance exceeds 6 million euros, and/or it has a minimum of 50 staff members. Please make sure you follow Dutch law, because not doing so might entail serious complications. Furthermore, the limited liability is only valid if there is no improper management. Not meeting these regulations and demands might actually result in improper management, which means that you can be held personally liable for any financial issues or debts you cause. The Dutch government can then obtain funds from your personal accounts; this is not something you want to happen.

17.What should I do to start the procedure for incorporation?

The incorporation of a Dutch BV can only be finalized by a public notary. After all shareholders agree on the incorporation deed, it is then executed before the notary. After incorporation, the company must submit its documents to the Dutch Chamber of Commerce and the Tax Authorities. In order to initiate the incorporation procedure, we need some basic information from you, including the number and details of the shareholders and the main scope of operations of the BV. According to the law in the Netherlands, the deed must be prepared in Dutch. A translated version is also necessary so that the shareholders understand the documents requiring their signature. In case you would like to see an example of standard Articles of Association (AoA), please let us know and we will send you a free sample. The process of incorporation can be finalized within 3 days, but the actual length of the procedure depends on the particular situation, the necessary issuance of a Power of Attorney (PoA) and the fulfillment of all identification requirements.

18.How does the process of incorporation work if I am not a resident of the Netherlands?

In general, the establishment of a Dutch BV by a foreign entrepreneur can be performed remotely, as we already discussed in a precious question. You can send many of the necessary documents via email, only some documents require that you send them via regular mail since they need to be legalized with an apostille by a public notary in your home country. Next to that, public notaries can execute deeds of incorporation through POA; therefore, the shareholder(s) do not have to be present in person. If you submit all documentation rapidly and correctly, the formation process should only take a few business days.

19.How long will the incorporation take?

As stated on our website, the incorporation process generally takes 3–5 business days. There are, of course, some exceptions. If you only want to establish one Dutch BV and you already have all the necessary documents at hand, the procedure can sometimes be finalized in just 1 or 2 business days. On the other hand, if you want to incorporate a more complicated business structure, if there are many different companies and shareholders, or if you also need visas, permits or licenses, you should take into account that the process might take longer. This is also the case when you want to deposit a higher share capital than is required for a Dutch BV. Feel free to contact Intercompany Solutions with any questions you might have regarding the incorporation procedure.

20.Can I freely choose the name of my Dutch BV?

There is one very important last thing you need to know before you start: it is not allowed to incorporate a company with a name already in use by another BV or included in the list of official trade names, such as Coca-Cola and Pepsi (which are very obvious examples). Contact us to check whether the name you like for your company is available at the beginning of the process of incorporation, since this will save you time later on if the name you want is already taken. The name also has to start or end with the abbreviation “BV”. Along with the main company name, you are free to include additional commercial names. This way, you will be able to represent multiple brands with one and the same legal entity, which is very practical.

Intercompany Solutions can incorporate your new Dutch BV company in just a few business days

If you have read all these questions and feel sure about your choice to incorporate a Dutch BV, then it is time for action. Intercompany Solutions has assisted hundreds of foreign entrepreneurs during the past few years with the establishment of a wide variety of business structures. We can start a new Dutch BV for you, incorporate a holding structure, establish a subsidiary that falls under your current foreign holding company, or look for a branch office for you. Please note that a branch office is not a legal entity and thus, does not qualify as a Dutch BV. We strongly advise that you choose to start a subsidiary, as this will provide you with all the necessary means to benefit from all the advantages that a Dutch BV has to offer. A BV will also provide you with direct access to the European Single Market, making it extremely easy for you to trade internationally in an efficient and cost-effective way. If you have any questions, you would still like to ask or would like to receive a personalized quote, feel free to contact us anytime.

Sources:

[1] https://longreads.cbs.nl/nederland-handelsland-2022/buitenlandse-investeringen-en-multinationals/

[3] https://www.amsterdamtips.com/multinational-companies

[4] https://ondernemersplein.kvk.nl/vergunningen/

If you want to establish a company overseas, you will have to take into account that your newly found company will be officially registered in the country you choose. In every country, there is a company register that holds all data regarding active and inactive businesses within that specific country. In the Netherlands, this trade register is overseen and updated by the Dutch Chamber of Commerce (‘Kamer van Koophandel’ in Dutch). In general, all companies, legal entities and organizations that participate in economic activity are registered in the trade register. This way, every entrepreneur can check important information about any company, such as who they are dealing with, who within a certain company is authorized to sign documents, and whether there has been a bankruptcy. This ensures that you have legal certainty when doing business. The company register is a public register, which is consulted by both natural persons and legal entities millions of times every year.

The Dutch Chamber of Commerce records a very wide variety of data in the trade register, such as the names, contact details and other personal information regarding officials within the company. Each registration receives a unique Chamber of Commerce number. Almost all the data is public, so you can find out whether a company of your interest exists, who is responsible and where the company is located. This also applies to the data of deregistered companies and organizations in connection with liability and any debts incurred in the past. Some data is only available to authorized persons, such as lawyers, notaries, bailiffs or judicial services. The exact nature of this restricted data is determined in the Dutch Trade Register Act, but in general, you should be able to access all relevant data regarding your specific query.

The publicly available data includes:

- The name of the company or organization

- All contact details of the company, such as an address, telephone number, fax number, e-mail address and internet address

- Branch office data

- Information regarding all officials and authorized signatories

- The trustee in case of bankruptcy

- The number of employees within the company

The UBO (Ultimate Beneficial Owner) register is part of the Trade Register, you can read more about this topic in this article we published earlier. Please be informed, though, that since November 22, 2022, this specific data has been temporarily unavailable to the public due to a ruling by the European Court of Justice1.

All Dutch companies are registered in the Netherlands’ trade register

Thus, all companies established in The Netherlands must be included in the company register of the Netherlands. When starting a business in the Netherlands, one of the first official steps you should take is to enlist your business in this register. Not only do the Dutch authorities use this register to keep track of all Dutch businesses, for example, for statistical purposes, but this database can also help individuals look up business names, the activities associated with a business, the accompanying registration numbers, and extensive accounting information. This means you can easily find out if a company you are engaging with in business is legitimate and legally capable of conducting business.

The Dutch Trade Register can also help you find out if someone is an authorized signatory for a certain company. In general, if your business isn’t registered in the trade register, you cannot conduct business with your company at all. The Dutch business register includes both Dutch companies and branches and subsidiaries of international companies operating in the country. These must all be included in the trade register.

The available information for each company includes (but is not necessarily limited to) the name and address of the business, a working telephone number to contact the company, the current number of employees, and certain details about the company’s representatives. You can also look up the company’s financial background, such as any bankruptcies that may have occurred during the history of the business. Most of the information found on the website of the Dutch Chamber of Commerce is free of charge, yet financial statements, documents that have been filed on behalf of the company, the history of the company, and corporate relationships are amongst the many additional pieces of information that can be purchased.

Why it’s important to look up the details of other companies

If you consider working with other companies or buying supplies from others, it is always wise to check whether a company is legitimate. Only businesses that are registered in the Dutch trade register are considered legitimate. Because they are registered, you can look up the information we have discussed above and, by doing so, find out more details about a certain company. In some cases, companies have dealt with bankruptcy and might have outstanding debts or other problems that might also negatively impact their own businesses. It is also important that you find out whether someone is doing business legally and is not involved in shady or illegal practices. When you partner up with a company that is involved in illegal activities, this can have serious consequences for the legitimacy of your own company. Furthermore, investigating someone’s past is an integral part of due diligence. If you want to do business with healthy companies, always make sure you have the most recent information available. This will save you from possible problems in the future.

Searching the Dutch company register online

If you want to request data from the trade register, you can easily do this online. Anyone can search for companies and organizations in the trade register by trade name, address or Chamber of Commerce number. The searching itself is free, as is the basic data the Chamber of Commerce provides for free. If you want more detailed information, such as an extract from the trade register or annual accounts, then keep in mind that some fees might be charged. These are generally minimal, though, so you won’t have to invest a lot to obtain the necessary information. Whether you are a Dutch-born citizen or a citizen of another country who is looking to establish a new business, in both cases, the Netherlands can suit you very well. Due to the bilingual capabilities of most residents, the Dutch Company Register is also set up with a bilingual website. English and Dutch versions of the site are available for ease of use by people even beyond the borders of the Netherlands. This adds to the user-friendly interface of the site, which makes information easily accessible in both languages. Another key feature of the website is the ease of payment for any additional information you may want to obtain. Online payment is available by using your credit card or iDEAL, and you can also choose to use the direct debit option from your bank account.

The Netherlands Chamber of Commerce regulates the national trade register, which is a register of all active companies in the Netherlands. This is handy in many cases, as it’s very easy to look up all sorts of information about Dutch companies. For example, for every new company registration in the Netherlands, the first step an entrepreneur will have to perform is a name check. Is the preferred name of the new Dutch company already taken? A quick search in the company register in the Netherlands will show if the name is available. Our firm can assist you with registering a name for your Dutch company. According to Dutch law, every legal entity will have to deposit annual account information with the Trade Register. The Dutch Chamber of Commerce’s function is to register this information. All annual accounts of Dutch companies are kept up to date by the Dutch Trade Register. You can find out details about potential business partners or companies that you consider competitors. This can provide you with very useful information that you can utilize for various goals, such as writing up a business plan, looking for investors or simply creating a forecast of the future for your business.

Intercompany Solutions: company register services in the Netherlands

Registering your new Dutch company is a task that you should preferably outsource to professionals in this specific field. Are you currently looking for local experts who have extensive knowledge regarding the corporate register of the Netherlands to help you incorporate a Dutch BV? Then you have found yourself at the right address. Our firm has the appropriate expertise to assist with your company's establishment in the company register of the Netherlands. Any entity providing goods or services to clients and generating profit from this activity is defined as a business. If you would like to make a new entry in the Netherlands’ company register or register a branch or subsidiary company that is already established abroad, rest assured that our experts can provide you with the necessary assistance.

Intercompany Solutions can help you with every step in the process of setting up your new business. We can also help you with applying for local banking, financial and local representative services if you are working out of the country. Once your business is up and running, we can also be of service when it comes to bookkeeping and taxation. Leaving the heavy lifting to us allows you to focus on the more important aspects of the business. Our full-service package consists of services such as:

- Registering your business in the company register of the Netherlands, which generally takes between 3-5 business days. In some cases, we can speed up the procedure to 1-2 business days.

- We can assist you in the administrative process of setting up a company and provide extra legal, financial and other services as needed.

- We can also register а subsidiary or branch office of your international company in the trade register of the Netherlands. Thus, your branch will be able to easily do business in the EU by obtaining an EORI number, a value-added tax number, and an account at a Dutch or other European bank.

- We can assist with opening a Dutch business bank account

- Obtaining the registration and VAT number for your company

- Financial services, such as taking care of your periodic tax returns

Requirements for the registration of a company in the Netherlands

There are a few requirements to open a Dutch business, which are equal for every entrepreneur:

A unique company name

One of the first things you will have to take care of is coming up with a new and unique company name. Once a certain name is already in use, it is generally protected by intellectual property and copyright laws. Needless to say, the current owner of a company with the name you desire won’t like it when you just copy the name. So, try to figure out something entirely unique that still fits well with your company’s goals and your personal ambitions.

Official translation of the notary deed

Since you will open a company in the Netherlands, you will also have to incorporate the company with the assistance of a Dutch notary. This means that the incorporation deed will be drafted in the Dutch language in most cases. You might need this deed of incorporation yourself, though, so it needs to be translated into English as well. Intercompany Solutions always provides you with an English translation, as this is a part of the total registration package we offer. It is also already included in the pricing.

Minimum share capital

The current minimum share capital to start a Dutch BV is 1 euro, which is normally divided into a certain amount of shares. In the past, the minimum share capital used to be 18,000 euros. Since the introduction of the so-called Flex-BV, however, this amount has been lowered to 1 euro. This has made the incorporation of a Dutch BV much easier and more attainable for entrepreneurs all over the world, seeing that not everyone has a start-up capital of 18,000 euros.

Ties to the Netherlands

In general, the Dutch government prefers that your business be tied to the Netherlands in some way or another. If you start a Dutch company, you should make sure that you do business with other Dutch companies or sell or buy products from Dutch natural persons. Another way to create ties with the country is to hire local personnel or move to the Netherlands yourself as a company owner. The authorities would like to see that the Netherlands also profits from your business being established here, as opposed to only you.

A Dutch registration address for your company

Last, but certainly not least, your company will need an official Dutch registration address in order to be registered. You can either hire an office space or opt for a virtual business address. There are many companies offering business addresses that often also digitally scan and save all your business communications. You can look for such services online, we advise that you choose an address in a well-known Dutch city, as this will do wonders for your general business image.

How can you protect your privacy?

Being listed in the trade register obviously offers many benefits, since you are operating a legitimate Dutch business and are thus able to trade freely within the entire EU. Nonetheless, it also means that your data is open to the public. One of the main purposes of the trade register is to obtain legal certainty, but other companies can also use the data that is stored for direct marketing purposes. This can become very annoying, especially if you receive a lot of telephone calls and emails. Unfortunately, there’s not much you can do about your data being public, but there are ways to limit the possibility of others contacting you. For example, you can use a non-mailing indicator or put your contact details on so-called ‘no contact’ lists. This way, others legally won’t be able to contact you. Private data, however, such as your private address, is restricted from viewing by the public. Private addresses of officers of legal entities (for example, the director of a BV) have not been public since 2008. The private addresses of the owner, partners and partners of any sole proprietorship, general partnership, CV, or partnership have no longer been public since January 1, 2022. Only employees of administrative bodies, lawyers, notaries and bailiffs can view this data if they have authorization to do so. Nonetheless, the Dutch Chamber of Commerce can only protect your business address in very exceptional situations2.

Incorporating a Dutch BV company in the Dutch Business Register

The most popular company type for foreign entrepreneurs in the Netherlands is the Dutch BV company. The Dutch BV is comparable to a private limited liability company. The BV has its own legal rights, and the owners and directors are not liable for the actions of the BV itself. The current type of BV company may be formed with as little as a €1 share capital deposit. The BV company is nowadays also known as ”Flex BV”, which has to do with the regulations that came into effect on October 1, 2012. This change made it much easier to establish a Dutch BV, especially for people with a low amount of starting capital.

The process of becoming registered can be fairly simple with the help of an expert on the subject, such as Intercompany Solutions. What you will need up front is as follows:

- The deed of incorporation

- All involved shareholders' details

- Details about the company’s managers

- A bank reference about the deposited share capital

- Authorization for Intercompany Solutions to act on your behalf, if you are not able to travel to the Netherlands

Once all of this information is gathered and submitted, you will be issued an access code. Only people with access codes are able to view the information contained in the Dutch Trade Register. A Netherlands company registration is finalized by an official registration in the Netherlands Trade Register. This means you will receive your own unique registration number that is linked to your Dutch business. For representation purposes, you will be seen as a company in the Netherlands, and with the Netherlands’ excellent reputation, this will allow you to do business in Europe much easier and with less legal and administrative hassle. A company registration in the Netherlands may be performed from anywhere globally, which means you can set up a Dutch business at any given time. Our service is to guarantee a smooth company registration procedure in the Netherlands and assist you with everything involved with starting your new business. We can also assist you with obtaining a Dutch VAT number and applying for a Dutch company bank account.

To register a BV, you might need a Netherlands incorporation agent to assist you with this rather complicated matter, especially if you don’t have any experience doing this. Such an incorporation agent is specialized in working with foreign entrepreneurs and the particularities of forming a Dutch BV as a foreigner. The incorporation agent has to perform due diligence on the client, identify them and prepare the incorporation forms. The incorporation forms will be certified by a notary public and published in the company register of the Netherlands. When the company register has the information for the new BV company, they will publish this immediately on the website of the Dutch Trade Register.

The BV is fully incorporated when the notary has passed the deed, the company register has published the information, and the shareholders have paid up the share capital to the BV company bank account. Intercompany Solutions can assist you during every step of this entire process, since we have many years of experience with the incorporation of foreign firms in the Netherlands. Simply contact us for professional personal advice or a direct quote.

Video explainers on starting a Dutch company

What Intercompany Solutions can do for you

We have assisted hundreds of foreign entrepreneurs from over 50 different nationalities during the past few years. Our clients range from small, one-person startups to multinational corporations. Our processes are specifically aimed at foreign entrepreneurs, since we know the most practical ways to assist with your company registration from multiple years of hands-on experience.

Next to the company registration procedure, we can assist you with the full package of services tied to company registration in the Netherlands:

- Opening of a local bank account

- Administration services

- Application for VAT or EORI number

- Tax services

- Startup assistance

- Media

- General business advice

Opening a Dutch corporate bank account

To apply for a bank account for your firm, you first need to have your company incorporated. After incorporation, you may pay the share capital to a bank account, that you open after the incorporation, to complete the process. Your bank account can be used right away for business transactions. We can assist you with the application for a business bank account in the Netherlands, since we work together with several banks.

Administration services

Next to opening a bank account, we can also assist your company with several administrative services. For example, we offer extensive secretarial services that can aid you in minimizing your workload. If you don’t have to take care of most administrative matters, you have much more time to focus on your core business and other necessary tasks, such as operational activities, acquisition and marketing.

Application for a VAT or EORI number

Next to having to register your company at the Dutch Chamber of Commerce, you will also have to apply for a Dutch VAT number. A VAT number is always necessary, since you will have to pay taxes and VAT that you billed to the tax authorities. Also, if you plan to do business internationally, you will need an Economic Operators Registration and Identification (EORI) number. This is a registration and identification number for all companies that trade goods into and out of the EU. Intercompany Solutions can arrange both for you.

Tax services

We offer a variety of services that are aimed at assisting you with periodical and yearly tax returns. These services are also linked to our administrative services, but you can choose whether you would like to make use of these services and which ones have your preference. Keep in mind, that it is very important that you take care of all financial matters meticulously. This will save you a lot of potential trouble and money in the future.

Start-up assistance